Bookkeeping is the administrative and financial process of systematically recording all business transactions into organised accounts.

It involves categorising financial data, reconciling accounts, and maintaining accurate records that support reporting, tax filing, compliance, audits, and informed decision-making.

Entities Related to Bookkeeping:

- Transactions

- General Ledger (GL)

- Chart of Accounts (COA)

- Bank Reconciliation

- Journals

- Accounts Payable (A/P)

- Accounts Receivable (A/R)

- Financial Statements

- Bookkeeper / Certified Bookkeeper

Why Bookkeeping Matters

Key reasons it’s essential:

- Ensures financial accuracy

- Helps track cash flow

- Enables tax compliance

- Supports audits

- Simplifies budgeting and forecasting

- Protects against fraud and errors

- Provides the data needed for strategic decisions

Without bookkeeping, a business operates blindly.

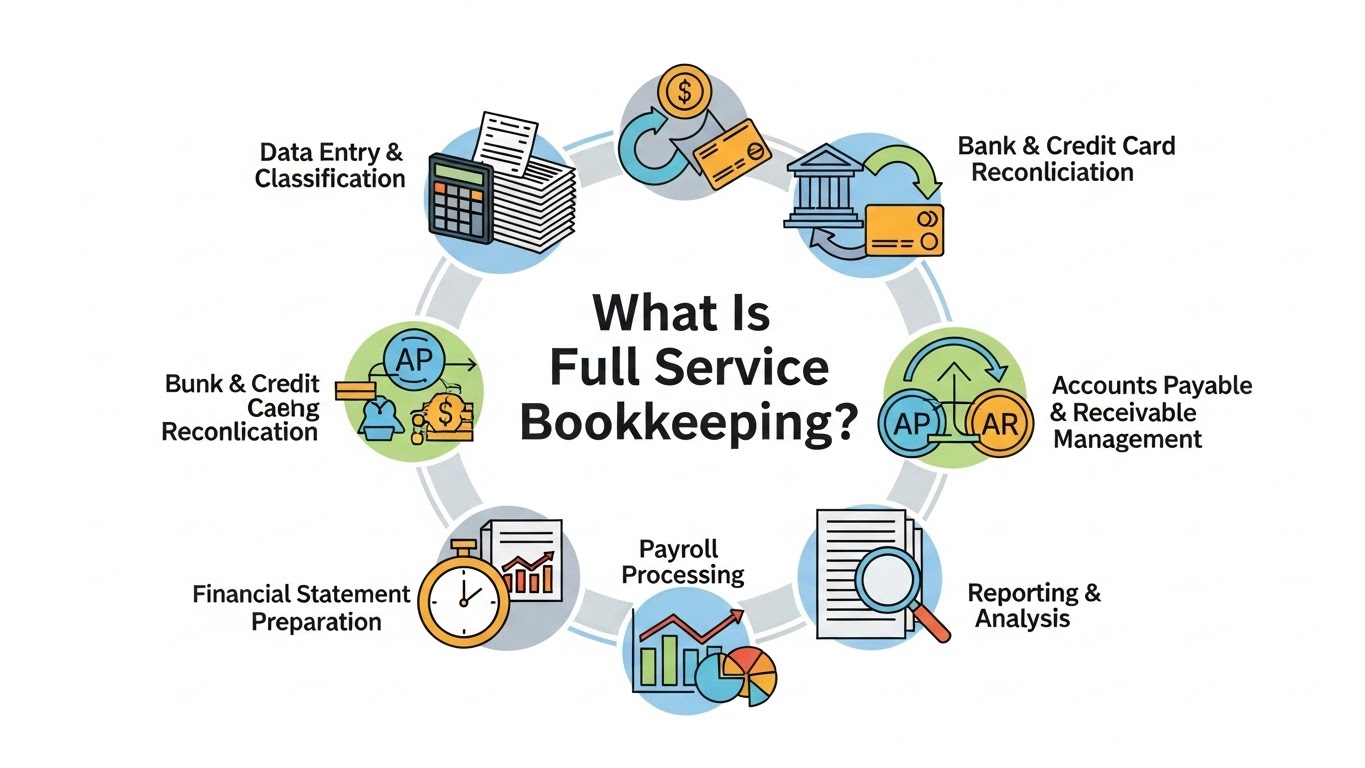

Key Bookkeeping Tasks

Daily/Weekly Tasks

- Recording sales invoices

- Recording expenses and supplier bills

- Managing receipts

- Reconciling cash registers and bank feeds

Monthly Tasks

- Bank and credit card reconciliation

- Preparing monthly reports

- Updating the general ledger

- Processing payroll data

Annual Tasks

- Preparing records for tax filing

- Reviewing year-end adjustments

Single-Entry vs. Double Entry Bookkeeping

Single Entry Bookkeeping

- Records each transaction once

- Suitable for small and simple businesses

- No formal ledger structure

- Limited accuracy

Double Entry Bookkeeping

- Records each transaction twice (debit & credit)

- Mandatory for GAAP and IFRS compliance

- Used by all serious businesses

- Ensures accuracy through self-balancing books

Example:

A business buys equipment for $1,000.

- Debit: Equipment

- Credit: Cash

Double-entry provides a holistic view of financial health.

Cash vs. Accrual Bookkeeping

Cash Basis

- Simple and easy

Accrual Basis

- Required for most growing businesses

- Provides a more accurate financial picture

Bookkeeping Systems and Software

Modern bookkeeping uses digital tools that automate data entry and reduce manual errors.

Popular bookkeeping software:

- QuickBooks Online

- Xero

- FreshBooks

- Wave Accounting

- Zoho Books

- Sage

These tools integrate banking feeds, invoicing, payroll, and financial reporting.

7. Core Bookkeeping Documents

A professional bookkeeping system maintains:

- General Ledger

- Trial Balance

- Journals (sales journal, purchase journal, cash book)

- Income Statement

- Balance Sheet

- Bank Statements

- Expense Receipts

- Invoice Records

- Payroll Records

These documents form the foundation of all accounting processes.

Bookkeeping vs. Accounting: What’s the Difference?

Bookkeeping

- Records and organises financial data

- Day-to-day process

- Transaction-focused

- Admin-based role

Accounting

- Interprets and analyses bookkeeping data

- Creates financial statements

- Handles audits, tax strategy, and forecasting

- Advisory role

Bookkeeping = Data Input

Accounting = Data Interpretation

Who Performs Bookkeeping?

Options include:

- In-house bookkeeper

- Freelance bookkeeper

- Virtual bookkeeping services

- Accounting firms

- Automated bookkeeping systems

- CB (Certified Bookkeeper)

- CPB (Certified Professional Bookkeeper)

The Bookkeeping Cycle Explained

The bookkeeping cycle includes:

- Identifying transactions

- Recording in journals

- Posting to the general ledger

- Balancing accounts

- Preparing trial balance

- Making adjusting entries

- Generating financial statements

- Closing the books

This cycle repeats monthly, quarterly, and annually.

Benefits of Professional Bookkeeping

Business benefits:

- Accurate financial reporting

- Better budgeting and planning

- Stress-free tax preparation

- Higher business valuation

- Strong financial governance

Operational benefits:

- Saves time

- Reduces errors

- Improves compliance

- Enhances decision-making

Common Bookkeeping Mistakes

Avoid these frequent errors:

- Mixing personal and business finances

- Missing receipts

- Ignoring bank reconciliation

- Categorising expenses incorrectly

- Not backing up financial data

Proper bookkeeping prevents these expensive mistakes.

Frequently Asked Questions

What exactly does a bookkeeper do?

A bookkeeper records financial transactions, categorises them, reconciles accounts, manages payroll data, and prepares reports.

Is bookkeeping the same as accounting?

No. Bookkeeping records data; accounting interprets it.

Do small businesses need bookkeeping?

Yes. Even micro-businesses need accurate books for taxes, compliance, and cash-flow management.

How much does bookkeeping cost?

Costs vary based on transaction volume, business size, and service type (in-house, outsourced, or remote).

What skills does a bookkeeper need?

Attention to detail, accounting knowledge, software proficiency, reconciliation skills, and financial literacy.