This section covers the bookkeeping process step by step, using plain language so even beginners can follow it.

Step 1: Set Up the Chart of Accounts (COA)

A Chart of Accounts organizes all your business transactions into categories such as:

-

Assets (Cash, Accounts Receivable)

-

Liabilities (Loans, Credit Cards)

-

Equity

-

Income

-

Expenses

This is the foundation of every bookkeeping workflow.

Step 2: Record Every Financial Transaction

Every time money moves through your business, it must be recorded. Examples:

-

Sales

-

Purchases

-

Expenses

-

Bank deposits

-

Loan payments

Bookkeepers use double-entry bookkeeping, meaning every transaction affects at least two accounts (debit & credit).

Step 3: Categorize Income & Expenses

Categorization helps you understand:

-

How much money you earned

-

Where money was spent

-

Areas of overspending

-

Tax-deductible expenses

Common categories for US small businesses include:

-

Advertising & Marketing

-

Payroll

-

Utilities

-

Office Supplies

-

Travel

-

Merchant Fees

This forms the small business bookkeeping basics.

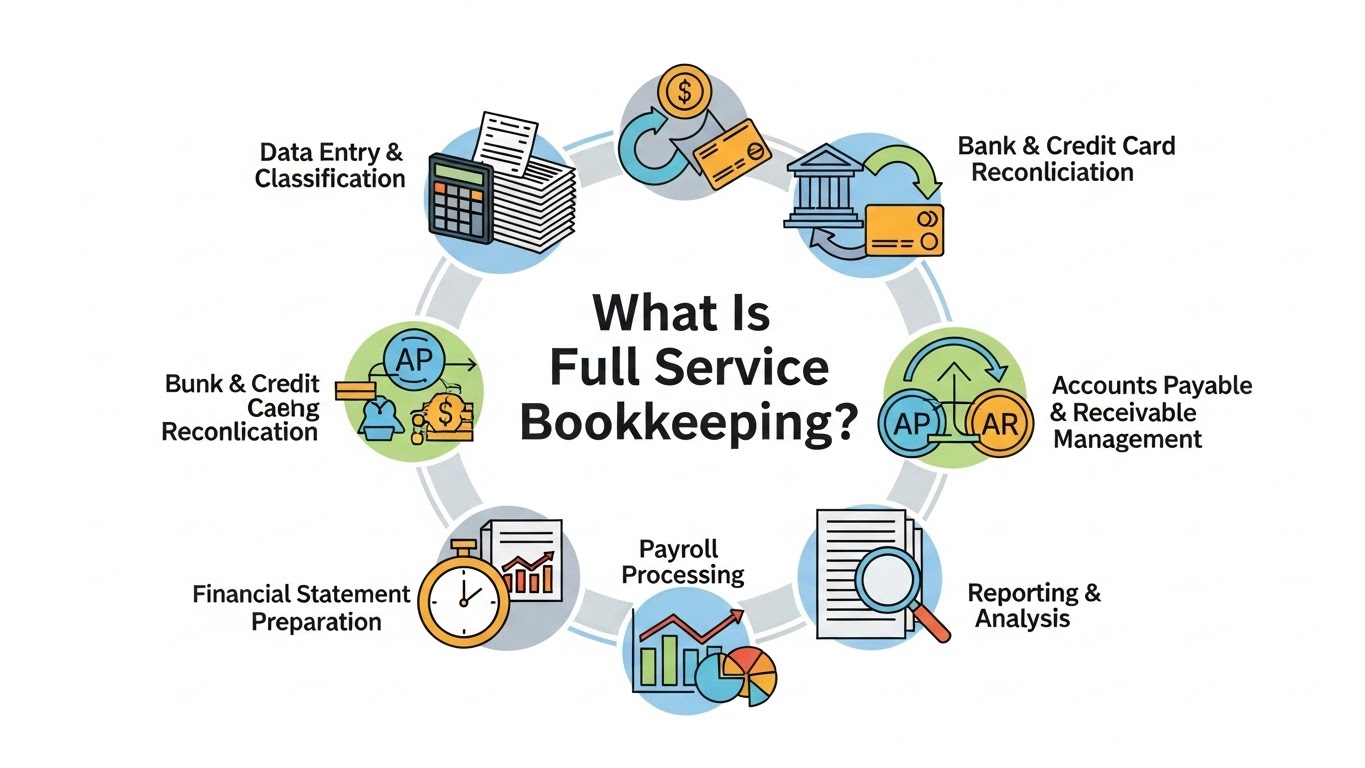

Step 4: Manage Invoices & Accounts Receivable

Bookkeepers track:

-

Invoices issued

-

Payments received

-

Overdue invoices

-

Customer balances

This keeps your cash flow healthy.

Step 5: Track Bills & Accounts Payable

To avoid late fees, bookkeepers:

-

Record all bills

-

Track due dates

-

Process vendor payments

-

Maintain vendor histories

This is crucial for bookkeeping for small business USA, where late payments affect credit and vendor relationships.

Step 6: Reconcile Bank & Credit Card Statements

Bank reconciliation ensures business records match bank data.

Why it matters:

-

Detects duplicate transactions

-

Catches fraud

-

Prevents errors

-

Ensures financial accuracy

This is one of the most important bookkeeping steps for small businesses.

Step 7: Run Financial Reports (Monthly & Quarterly)

The main reports include:

Income Statement (P&L)

Shows profit or loss.

Balance Sheet

Shows assets, liabilities, and equity.

Cash Flow Statement

Shows real cash movement.

These reports help business owners make smart decisions.

Step 8: Maintain Organized Financial Records

US businesses must keep financial records for 3–7 years depending on the IRS guideline.

Bookkeepers maintain:

-

Receipts

-

Invoices

-

Bank statements

-

Tax documents

-

Payroll reports

-

Expense documentation

This helps with tax filing and audits.

Step 9: Prepare for Taxes

Bookkeepers do NOT file taxes (accountants do), but they organize all data required for:

-

IRS income tax

-

Payroll tax

-

Sales tax

-

Estimated quarterly taxes

How Bookkeeping Works for Small Businesses in the USA

Small businesses in the US follow a standardized bookkeeping workflow due to IRS and GAAP requirements.

Key US-specific bookkeeping tasks:

-

Categorizing deductible expenses per IRS categories

-

Maintaining mileage logs

-

Tracking 1099 contractor payments

-

Recording business credit card transactions

-

Preparing financials for certified tax preparers

This ensures compliance and avoids costly penalties.

Bookkeeping for Beginners: Simple Workflow

If you’re a beginner or doing your own bookkeeping:

Start with:

-

Choose a system (QuickBooks, Xero, Wave)

-

Connect your bank account

-

Categorize transactions weekly

-

Reconcile monthly

-

Review reports monthly

This is the easiest bookkeeping guide for small business owners.

Why Bookkeeping Matters

Bookkeeping builds:

Experience

Accurate records help you track your financial history.

Expertise

Proper bookkeeping ensures financial health and strategy.

Authority

Clean financials build trust with banks, investors, and the IRS.

Trustworthiness

Reliable data reduces errors, penalties, and cash flow gaps.

Frequently Asked Questions (FAQs)

1. What is the basic bookkeeping process?

It includes recording, categorizing, reconciling, and reporting financial transactions.

2. How does bookkeeping work for a small business?

It tracks all income, expenses, invoices, bills, payroll, and bank reconciliations to maintain accurate financial data.

3. Do I need bookkeeping if I’m a small business owner?

Yes. Without bookkeeping, you won’t know your profit, cash flow, or tax liability.

4. Can beginners do bookkeeping?

Yes, with simple software like QuickBooks or Wave and a weekly routine.

5. What are the key bookkeeping steps for small businesses?

Setup → Record → Categorize → Reconcile → Report → Maintain Records → Prepare for Taxes.

6. Is bookkeeping different from accounting?

Yes. Bookkeeping records data; accounting analyzes it.