Bookkeeping focuses on recording daily financial transactions like sales, expenses, invoices, and payroll. Accounting goes a step further by analyzing, interpreting, and reporting that financial data to support tax compliance, financial planning, and strategic business decisions.

In short:

Bookkeeping = record-keeping

Accounting = analysis, insights, and compliance

Both are essential, especially for small businesses that want accurate finances, tax readiness, and sustainable growth.

What Is Bookkeeping?

Bookkeeping is the foundation of a company’s financial system. It involves systematically recording and organizing financial transactions to ensure accurate and up-to-date records.

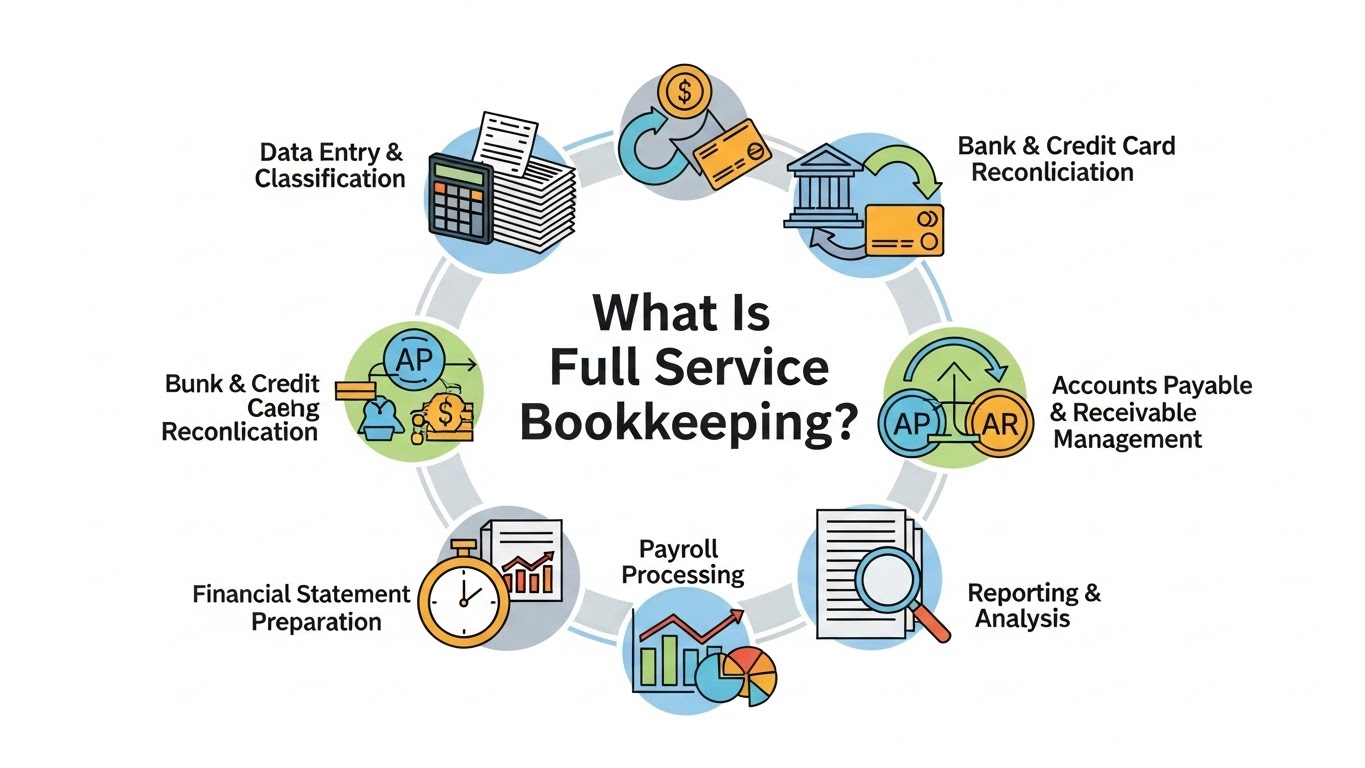

Core Bookkeeping Tasks

-

Recording income and expenses

-

Managing invoices and bills

-

Bank and credit card reconciliation

-

Payroll processing

-

Maintaining general ledgers

-

Tracking accounts receivable & payable

Professional bookkeeping services ensure your financial data is clean, consistent, and compliant with accounting standards.

Who Needs Bookkeeping?

-

Startups and small businesses

-

Freelancers and solopreneurs

-

E-commerce businesses

-

Service-based companies

Bookkeeping services for small business owners help save time, reduce errors, and provide clarity on cash flow.

What Is Bookkeeping? Meaning, Basics & Why It Matters

What Is Accounting?

Accounting builds on bookkeeping data to provide insights, reports, and compliance support. Accountants interpret financial information to help businesses understand performance and plan for the future.

Core Accounting Tasks

-

Preparing financial statements (P&L, Balance Sheet, Cash Flow)

-

Tax planning and tax filing

-

Financial analysis and forecasting

-

Budgeting and cost control

-

Compliance with IRS and GAAP

-

Advisory and strategic decision-making

Professional accountants for small businesses help owners reduce tax liabilities, improve profitability, and stay compliant.

Bookkeeping vs Accounting: Side-by-Side Comparison

| Aspect | Bookkeeping | Accounting |

|---|---|---|

| Purpose | Record transactions | Analyze & interpret data |

| Focus | Daily financial activities | Financial strategy & compliance |

| Skills Required | Data entry, organization | Analysis, tax knowledge |

| Output | Transaction records | Financial statements & reports |

| Timing | Ongoing, daily | Periodic (monthly/annually) |

| Tools Used | QuickBooks, Xero, Wave | Accounting software + tax tools |

Both roles work together to support business bookkeeping services and long-term financial health.

How Bookkeeping and Accounting Work Together

Bookkeeping provides accurate data; accounting turns that data into actionable insights. Without proper bookkeeping, accounting reports become unreliable. Without accounting, bookkeeping data lacks strategic value.

That’s why many firms offer accounting bookkeeping services as an integrated solution.

How Bookkeeping Works: Step-by-Step

Bookkeeping Services for Small Businesses

Outsourced bookkeeping is a cost-effective solution for growing businesses.

Benefits of Professional Bookkeeping Services

-

Accurate and timely financial records

-

Improved cash flow management

-

Reduced risk of IRS penalties

-

More time to focus on operations

-

Scalable support as your business grows

Business bookkeeping services are especially valuable for small businesses without an in-house finance team.

Virtual Accounting Services: A Modern Solution

With cloud technology, businesses no longer need local accountants.

Advantages of Virtual Accounting Services

-

Remote access to financial data

-

Real-time reporting and dashboards

-

Lower costs than in-house staff

-

Secure cloud-based systems

-

Expertise across multiple industries

Virtual accounting services combine bookkeeping, accounting, and advisory support ideal for modern small businesses in the USA.

Which One Does Your Business Need?

Ask yourself:

-

Do you need help tracking daily transactions? → Bookkeeping

-

Do you need tax planning and financial reports? → Accounting

-

Do you want a complete financial solution? → Both

Most small businesses benefit from combined bookkeeping and accounting services, especially as they scale.

Common Myths About Bookkeeping vs Accounting

Myth 1: Bookkeeping and accounting are the same

False: they serve different but connected roles

Myth 2: Small businesses don’t need accountants

False: tax compliance and planning are critical

Myth 3: Software replaces professionals

False: software supports professionals, it doesn’t replace expertise

FAQs: Bookkeeping vs Accounting

1. Is bookkeeping cheaper than accounting?

Yes. Bookkeeping services usually cost less because they focus on transaction recording rather than analysis and advisory.

2. Do small businesses need both bookkeeping and accounting?

Most small businesses benefit from both, especially for tax filing, compliance, and growth planning.

3. Can accountants do bookkeeping?

Yes, but many businesses use separate bookkeeping services for small business to reduce costs.

4. What software is used for bookkeeping and accounting?

Common tools include QuickBooks, Xero, FreshBooks, and Wave, often paired with tax and reporting software.

5. Are virtual accounting services secure?

Yes, reputable firms use encrypted, cloud-based platforms that meet industry security standards.