To start a bookkeeping business in the USA in 2026, you need to choose a niche, develop bookkeeping skills or certification, register your business legally, obtain an EIN, set up business bank accounts, select bookkeeping software, create pricing packages, comply with IRS and state regulations, purchase insurance, build a website, and market to small businesses. Most bookkeepers begin virtually, serving industries such as real estate, e-commerce, medical practices, trades, and professional services.

Step-by-Step Checklist to Start a Bookkeeping Business

| Step | Task | Description | Status |

|---|---|---|---|

| 1 | Learn bookkeeping basics | Double-entry, GAAP, financial statements | ☐ |

| 2 | Get certification (optional) | CPB, CB, QuickBooks ProAdvisor, Xero Advisor | ☐ |

| 3 | Select niche | e-commerce, real estate, medical, contractors | ☐ |

| 4 | Write business plan | services, pricing, target audience | ☐ |

| 5 | Choose entity type | Sole Prop, LLC, S-Corp (later) | ☐ |

| 6 | Register business | Secretary of State filing | ☐ |

| 7 | Apply for EIN | IRS employer identification number | ☐ |

| 8 | Open business bank account | Separate finances legally | ☐ |

| 9 | Get business insurance | E&O, cyber liability, general liability | ☐ |

| 10 | Choose bookkeeping software | QBO, Xero, FreshBooks, Wave, Zoho Books | ☐ |

| 11 | Build website | services, pricing, contact, testimonials | ☐ |

| 12 | Create service packages | starter, growth, premium | ☐ |

| 13 | Marketing plan | SEO, LinkedIn, referrals, CPA partnerships | ☐ |

| 14 | Sign first client | onboarding & engagement letter | ☐ |

| 15 | Maintain compliance | IRS, GAAP, state rules | ☐ |

Bookkeeping demand continues to grow due to:

-

rise in freelancers and LLCs

-

cloud accounting technology

-

remote and virtual service acceptance

-

increased IRS compliance enforcement

-

business owners outsourcing finance functions

Key advantages

-

low startup costs

-

recession-resistant service

-

predictable recurring revenue

-

fully remote opportunity

-

scalable with staff/bookkeepers

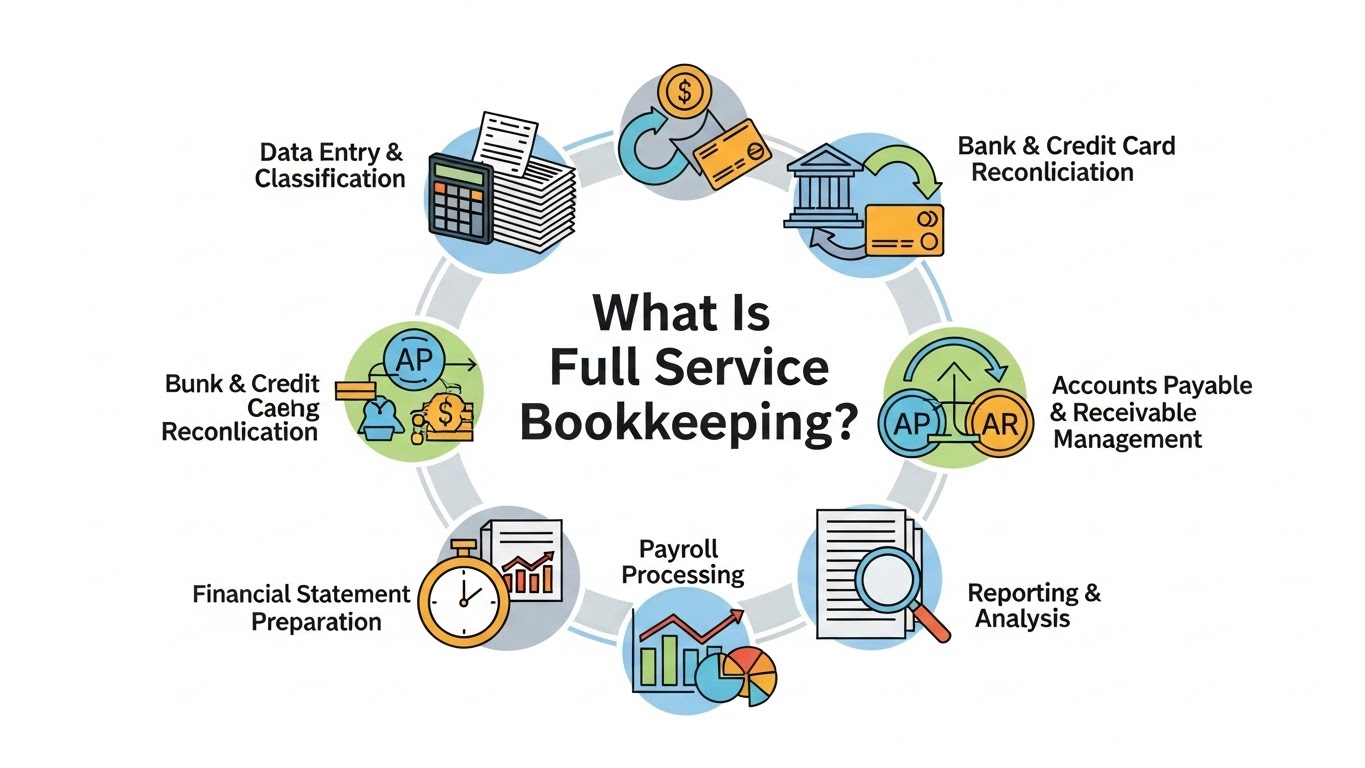

What Does a Bookkeeper Do? (Scope of Services)

Common bookkeeping services include:

-

accounts payable & receivable

-

bank and credit card reconciliation

-

monthly financial statements

-

chart of accounts setup

-

payroll processing support

-

expense categorization

-

fixed asset tracking

-

sales tax recording

-

cash flow tracking

-

1099 contractor records

-

software cleanup & catch-up work

-

support for CPAs and tax preparers

Note: Bookkeepers generally do not file taxes unless properly credentialed and compliant with IRS requirements.

Step-by-Step: How to Start a Bookkeeping Business in the USA

Step 1: Build Your Skills & Qualifications

While not legally required in most states, credentials increase trust.

Helpful certifications (not mandatory but high-trust)

-

CPB Certified Public Bookkeeper

-

CB Certified Bookkeeper (AIPB)

-

QuickBooks ProAdvisor

-

Xero Certified Advisor

-

CPA (if you are licensed already)

Certifications & Credentials for Trust Building

| Certification | Issuing Body | Benefit |

|---|---|---|

| CPB | NACPB | Recognized U.S. bookkeeper credential |

| CB | AIPB | Professional credibility |

| QuickBooks ProAdvisor | Intuit | Software expertise badge |

| Xero Advisor | Xero | Cloud accounting credibility |

| CPA (if licensed) | State Boards & AICPA | Authority for tax/advisory work |

Essential competencies

-

double-entry bookkeeping

-

understanding of GAAP

-

payroll basics

-

sales tax handling

-

financial reporting

-

ethics & confidentiality

-

technology workflows

Step 2: Choose Your Bookkeeping Niche

Niches reduce competition and increase pricing power.

High-demand niches in 2026:

-

e-commerce sellers

-

real estate investors

-

trucking & logistics

-

restaurants & cafes

-

contractors & home services

-

dental & medical clinics

-

law firms

-

SaaS startups

-

fitness studios

-

consultants & coaches

You may provide:

-

monthly bookkeeping packages

-

cleanup & catch-up projects

-

virtual CFO services (if qualified)

Profitable Niches for Bookkeeping Businesses

| Niche | Why It’s Profitable | Typical Needs |

|---|---|---|

| E-commerce | high transactions | inventory, PayPal/Amazon sync |

| Real estate investors | multiple entities | rent roll tracking, depreciation |

| Medical & dental | recurring revenue | payroll, insurance reconciliation |

| Law firms | trust accounting | compliance, retainers |

| Construction & trades | job costing | project profitability |

| Coaches & consultants | recurring retainers | invoicing & expense tracking |

| Trucking & logistics | fuel & maintenance tracking | multi-state expenses |

Step 3: Create a Business Plan

Include:

-

target market & niche

-

services offered

-

pricing model

-

software stack

-

marketing channels

-

revenue goals

-

legal structure plan

-

competitive analysis

Step 4: Register Your Business Legally

Legal compliance matters

Typical structures in the USA

-

Sole Proprietorship

-

LLC (recommended for liability protection)

-

PLLC (in some regulated states)

-

S-Corporation (for tax benefits in later growth stage)

You will generally:

-

File formation documents with your Secretary of State

-

Obtain an EIN from the IRS

-

Register for state/local licenses if required

-

Open a business bank account

Consult a CPA or attorney for personalized legal/tax guidance.

Legal & Compliance Requirements (USA)

| Requirement | Who Issues It | When Needed |

|---|---|---|

| Business registration | Secretary of State | Always |

| EIN | IRS | Required for taxes & bank |

| Business license | City/County | Sometimes |

| Operating agreement (LLC) | Internal or attorney | Recommended |

| Engagement letter | You → client | Always |

| Insurance | Private insurer | Strongly recommended |

Step 5: Understand U.S. Compliance & Ethics

Important U.S. regulatory entities & frameworks:

-

IRS (Internal Revenue Service)

-

FASB & GAAP standards

-

State business licensing authorities

-

FTC data privacy expectations

-

AICPA ethics (if CPA)

Bookkeepers should understand:

-

IRS small-business recordkeeping requirements

-

1099 and W-9 processes

-

payroll reporting basics

-

sales tax rules (state-specific)

Step 6: Set Up Your Tech & Bookkeeping Software

Core bookkeeping software options:

-

QuickBooks Online

-

Xero

-

FreshBooks

-

Wave

-

Zoho Books

Supporting apps:

-

Gusto or ADP (payroll)

-

Hubdoc, Dext, or ReceiptBank (receipt capture)

-

Bill.com (AP automation)

-

Stripe/PayPal syncing tools

-

Practice management tools (Canopy, Jetpack, ClickUp)

Cloud accounting is preferred in 2026 for:

-

security

-

collaboration

-

automation

-

remote access

Best Bookkeeping Software for Startups (USA 2026)

| Software | Best For | Pros | Skill Level |

|---|---|---|---|

| QuickBooks Online | Most small businesses | Most popular, integrations, reports | Beginner–Intermediate |

| Xero | Startups & online businesses | Clean UI, multi-currency | Intermediate |

| FreshBooks | Freelancers & service providers | Simple invoicing | Beginner |

| Zoho Books | Cost-effective users | CRM + accounting ecosystem | Intermediate |

| Wave | New freelancers | Free basic features | Beginner |

Step 7: Price Your Bookkeeping Services

Common pricing models

-

monthly packages

-

hourly (less recommended)

-

value-based pricing

-

per-transaction or per-account pricing

Typical U.S. price ranges depend on:

-

complexity

-

niche

-

location

-

number of accounts

-

deliverables included

Popular packages:

-

Starter bank rec + categorization

-

Growth full monthly bookkeeping + reporting

-

Premium advisory + KPI dashboards (if qualified)

Pricing Packages (You Can Customize)

| Package | Ideal Client | What’s Included | Monthly Range (USD) |

|---|---|---|---|

| Starter | Freelancers, solopreneurs | Categorization, 1–2 accounts, monthly rec | $150–$300 |

| Growth | Small businesses | AP/AR, reports, up to 4 accounts | $300–$700 |

| Established | Multi-entity firms | Full bookkeeping + payroll support | $700–$1,200 |

| Premium | Scaling companies | KPIs, cash flow support, advisory (if qualified) | $1,200+ |

Step 8: Protect Yourself with Insurance

Strong trust signal for U.S. clients.

Consider:

-

professional liability (E&O)

-

general business liability

-

cyber liability insurance

-

data breach protection

Step 9: Build Your Online Presence

To attract clients in 2026 you should have:

-

professional website

-

Google Business Profile

-

LinkedIn company page

-

niche-specific landing pages

-

reviews & testimonials

-

case studies if available

Add SEO keywords:

-

bookkeeping services USA

-

virtual bookkeeping services

-

accountants for small businesses

-

bookkeeping for small business owners

-

online bookkeeping business

Step 10: Get Your First Clients

Best acquisition channels:

-

LinkedIn outreach to small-business owners

-

networking with CPAs and tax preparers

-

freelancing marketplaces

-

local chambers of commerce

-

content marketing & blogs

-

email marketing funnels

-

niche-specific Facebook groups

-

referrals from attorneys or payroll companies

Offer:

-

free discovery call

-

audit of books

-

fixed-fee onboarding

Strengthening Trust Signals

To maximize credibility:

-

disclose qualifications & experience

-

show your business address & business entity

-

publish detailed service descriptions

-

demonstrate software certifications

-

provide real testimonials or case studies

-

maintain privacy policy & disclaimers

-

avoid implying tax authority if unlicensed

Common Mistakes to Avoid

-

charging too little

-

accepting every type of business

-

skipping engagement agreements

-

mixing business and personal banking

-

not backing up client data

-

doing tax filings without credentials

-

ignoring ongoing education

FAQ | How to Start a Bookkeeping Business (USA)

1. Do I need to be a CPA to start a bookkeeping business?

No. A CPA license is not required to offer bookkeeping services in the USA, but credentials increase trust.

2. Is starting a bookkeeping business profitable in 2026?

Yes. Demand continues to grow, especially in remote and virtual bookkeeping services.

3. How much can bookkeepers earn in the USA?

Earnings vary, but many independent bookkeepers earn $50,000–$120,000+ annually depending on client volume and specialization.

4. Do I need certification to be a bookkeeper?

Not legally but CPB, CB, and QuickBooks certifications improve credibility.

5. Can I run a bookkeeping business from home?

Yes. Many U.S. bookkeeping businesses are fully virtual.

6. What licenses are required?

Requirements vary by state. Generally:

-

business registration

-

EIN

-

local business license (in some areas)

7. What is the difference between bookkeeping and accounting?

Bookkeeping records transactions; accounting interprets financial information and may involve advisory or tax services.

8. Can bookkeepers file taxes?

Only if appropriately credentialed and compliant with IRS regulations.

9. How long does it take to start a bookkeeping business?

Many bookkeepers launch within 30–90 days depending on licensing, branding, and client acquisition.

10. What is the best bookkeeping niche in 2026?

Top niches include e-commerce, medical practices, real estate, trades, and online coaches.

Final Takeaway

Starting a bookkeeping business in the USA in 2026 offers:

-

strong income potential

-

remote flexibility

-

recurring clients

-

low start-up investment

With the right niche, compliance, pricing, and marketing strategy, you can build a profitable and trusted bookkeeping practice.