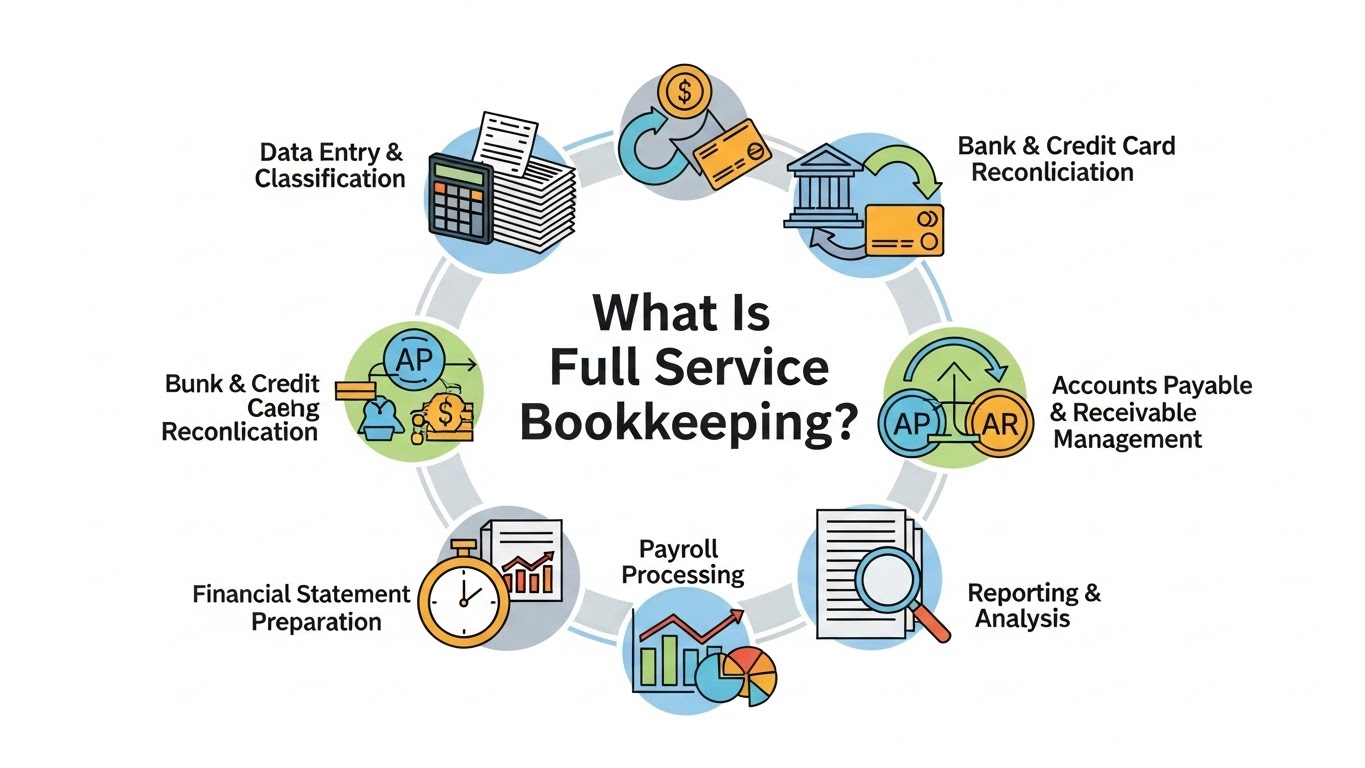

Full service bookkeeping is a complete financial management solution where a professional bookkeeper handles all daily, monthly, and year-end bookkeeping tasks for a business. This includes recording transactions, managing accounts payable and receivable, bank reconciliations, payroll support, financial reporting, tax-ready books, and ongoing financial oversight—so business owners can focus on growth instead of spreadsheets.

What Does Full-Service Bookkeeping Include?

A full-service bookkeeping package typically includes the following core functions:

1. Daily Transaction Recording

-

Categorizing income and expenses

-

Recording sales, vendor bills, and operational costs

-

Maintaining accurate general ledger entries

2. Bank & Credit Card Reconciliation

-

Monthly reconciliation of bank accounts

-

Matching transactions with statements

-

Identifying discrepancies or errors

3. Accounts Payable (AP)

-

Managing vendor bills

-

Tracking due dates

-

Ensuring timely payments

4. Accounts Receivable (AR)

-

Creating and sending invoices

-

Tracking customer payments

-

Following up on outstanding balances

5. Payroll Coordination

-

Payroll data preparation

-

Employee expense tracking

-

Compliance support (W-2s, 1099s, payroll summaries)

Note: Payroll filing is often handled in coordination with payroll providers like Gusto, ADP, or QuickBooks Payroll.

6. Financial Reporting

-

Profit & Loss (Income Statement)

-

Balance Sheet

-

Cash Flow Statement

-

Monthly or quarterly financial summaries

7. Tax-Ready Books

-

Clean, organized records for CPAs

-

Support for quarterly estimated taxes

-

Year-end closing and adjustments

Full Service Bookkeeping vs Basic Bookkeeping

| Feature | Basic Bookkeeping | Full-Service Bookkeeping |

|---|---|---|

| Data entry | ✅ | ✅ |

| Reconciliation | Limited | ✅ Monthly |

| AP & AR management | ❌ | ✅ |

| Financial reports | ❌ | ✅ |

| Payroll support | ❌ | ✅ |

| Tax readiness | ❌ | ✅ |

| Advisory insights | ❌ | ✅ |

Who Needs Full-Service Bookkeeping?

Full-service bookkeeping is ideal for:

-

Small businesses in the USA

-

Startups and funded companies

-

E-commerce businesses

-

Professional service firms

-

Real estate & construction companies

-

Nonprofits

-

Remote and online businesses

If you don’t want to manage financial records yourself—or risk IRS penalties—full-service bookkeeping is the right solution.

Benefits of Full Service Bookkeeping for US Businesses

1. IRS Compliance & Accuracy

Accurate bookkeeping ensures compliance with IRS guidelines, GAAP standards, and state tax requirements.

2. Better Cash Flow Management

Up-to-date books help track cash inflows and outflows, preventing surprises.

3. Time & Cost Savings

Outsourcing full-service bookkeeping is more affordable than hiring an in-house accountant.

4. Financial Clarity

Monthly reports give business owners a clear view of profitability and expenses.

5. Scalable Support

As your business grows, full service bookkeeping scales with your needs.

Full Service Bookkeeping Software & Tools (USA)

Most US bookkeeping providers use industry-standard tools, including:

-

QuickBooks Online

-

Xero

-

FreshBooks

-

Wave Accounting

-

Bill.com

-

Gusto / ADP (Payroll)

These tools support cloud-based, virtual bookkeeping services, allowing business owners to access financial data anytime.

Full Service Bookkeeping vs Accounting

Many business owners ask:

Is full service bookkeeping the same as accounting?

Not exactly.

-

Bookkeeping focuses on recording and organizing financial data

-

Accounting focuses on analysis, tax planning, and strategy

Full-service bookkeeping often works alongside accountants or CPAs, providing them with clean, accurate records.

How Much Does Full Service Bookkeeping Cost in the USA?

Pricing depends on:

-

Monthly transaction volume

-

Business size

-

Payroll needs

-

Industry complexity

Average US pricing:

-

Small businesses: $300 – $800/month

-

Growing businesses: $800 – $2,000+/month

How to Choose the Right Full Service Bookkeeping Provider

When selecting a provider in the USA, look for:

-

Experience with US tax laws

-

Certified bookkeepers or CPAs

-

Secure cloud-based systems

-

Industry-specific expertise

-

Clear pricing & monthly reporting

-

Virtual bookkeeping capabilities

FAQs: What Is Full-Service Bookkeeping?

Is full-service bookkeeping worth it for small businesses?

Yes. It saves time, reduces errors, and ensures tax-ready financial records.

Does full-service bookkeeping include taxes?

It prepares books for taxes but usually works alongside a CPA for tax filing.

Can full-service bookkeeping be done virtually?

Yes. Most US providers offer virtual bookkeeping services using cloud software.

How often are financial reports provided?

Typically monthly, but weekly or quarterly reporting is also available.

Is full-service bookkeeping compliant with IRS requirements?

Yes, when handled by qualified professionals using GAAP-compliant systems.

Final Thoughts

Full-service bookkeeping is more than just data entry—it’s a complete financial management solution for US businesses. By outsourcing bookkeeping to experienced professionals, business owners gain clarity, compliance, and confidence to grow their business.